Digital Banking

Manage your finances anytime and anywhere with IMCU Digital Banking. See below for enrollment guides, tutorials and features of mobile and online platforms.

Please note: You will need to use a recent version (last 2 releases) of Google Chrome, Apple Safari or the last version of Microsoft Edge.

Exciting Features:

- Payment and card features give you more control

- Transfer features provide more access and more options

- "Card Swap" feature offers seamless transition with expired, reissued or lost/stolen cards

- Nickname accounts for easy identification

- Send money via your IMCU debit card to anyone with an email/mobile phone number

- Robust financial tools allow access to your full financial portfolio

Download the App Today!

Digital Banking - Enrollment instructions

Multi-Factor Login Options

We are excited to introduce you to the new way you can now authenticate yourself when you login to IMCU Digital Banking.

This improvement is user-friendly, secure and will improve security.

So what is improving?

-

Improved login method via biometric authentication

-

No need for an additional app

-

Easy self-service password reset

-

Peace of mind knowing you are using best-in-class security measures

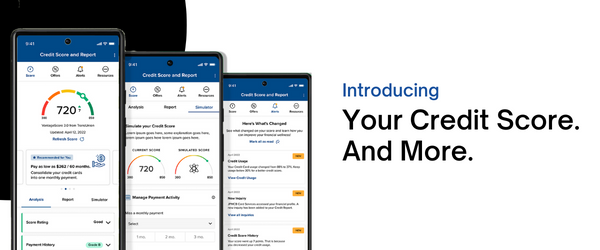

Credit Score and More

Your Credit Score. And More.

Anytime. Anywhere.

STAYING ON TOP OF YOUR CREDIT HAS NEVER BEEN EASIER

With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education.

You can do this ANYTIME and ANYWHERE and for FREE.

Instructional Videos

Digital Card Issuance

IMCU is now offering digital cards!

Using a card in a digital wallet is not only the safest method for transactions but also the most convenient. No more fumbling for your card; simply access your digital wallet through your device and tap it for authorization.

FAQs

- Enrollment/Access to Accounts

- General Consumer Banking FAQs

- Commercial Banking FAQs

- Multi-factor Authentication FAQs

- Resetting Password

- Setting Up Alerts

- How to Link an Account

- How to Add an External Account

Keep it simple, with online banking.