Credit Score And More

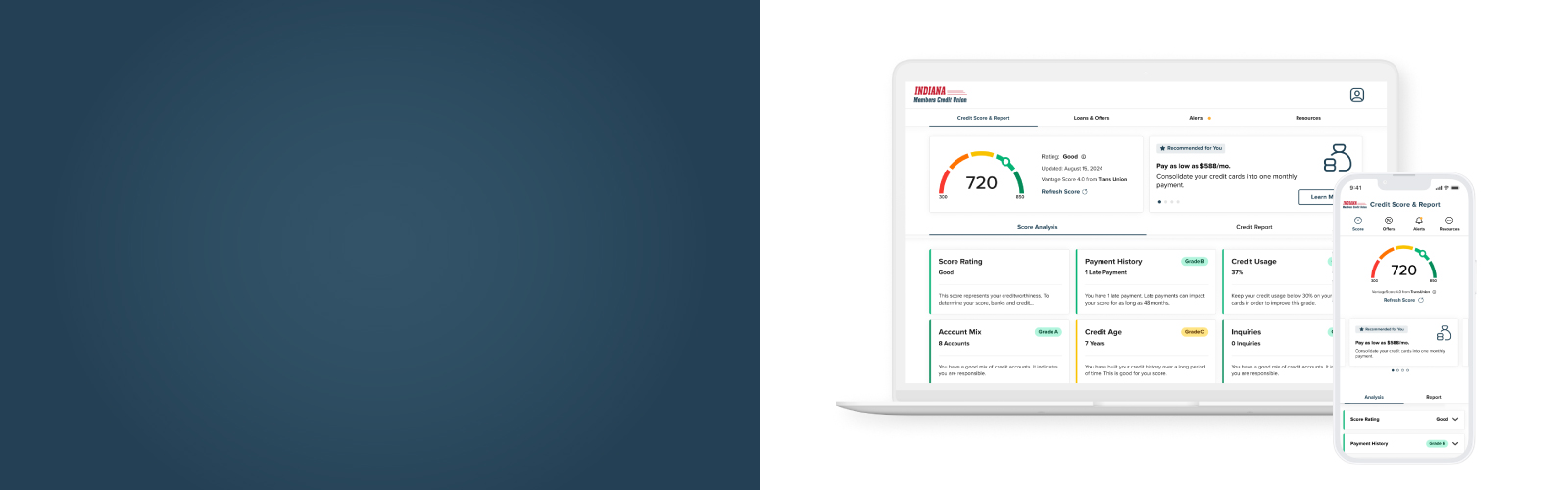

Introducing Your Credit Score. And More. Anytime. Anywhere.

STAYING ON TOP OF YOUR CREDIT HAS NEVER BEEN EASIER

With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education.

You can do this ANYTIME and ANYWHERE and for FREE.

BENEFITS OF CREDIT SCORE:

Daily Access to you Credit Score |

Real-Time Credit Monitoring Alerts |

Credit Score Simulator |

|---|---|---|

Personalized Credit Report |

Special Credit Offers |

And More! |

YOUR CREDIT SCORE. DAILY. AND SECURE.

Access your credit score and report in our mobile app and online banking.

-

SavvyMoney is a comprehensive platform that provides users free and ongoing access to their latest credit scores and reports, real-time credit monitoring, and savings opportunities on existing and new loans and credit cards – all through their online and mobile banking.

-

SavvyMoney Credit Report provides users with all the information they would find on a credit file including a list of current or previous loans and accounts and credit inquiries. Users can see details on their payment history, credit utilization, and the public records on their accounts. Like Credit Score, when a user checks their credit report, there’s no impact on their credit score.

- No. SavvyMoney is entirely free to the user, and no credit card information is required to register.

-

Every 7 days scores are updated and displayed in digital banking. Users can also refresh their score and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score Dashboard within digital banking.

-

SavvyMoney pulls users’ credit profiles from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 4.0.

-

There are three major credit reporting bureaus—Equifax, Experian, and Transunion—and two scoring models—FICO or VantageScore—that determine credit scores. Financial institutions use different bureaus and scoring models. Over 200 factors of a credit report may be considered when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical although there are similarities. SavvyMoney Credit Scores are represented in ranges, shown as follows:

- 780–850 – This scoring range is considered “Excellent.” Users in this range have very healthy credit histories and are usually eligible for the lowest rates on loans and offers on credit cards.

- 660-779 – This score range is considered “Good.” These users have good credit but may have a few minor issues. These users may still receive favorable rates on loans and cards.

- 600-659 – This scoring range is considered “Fair.” Users in this range may not get the lowest rates on loans and opportunities to borrow start becoming limited.

- 500-599 – This scoring range is “Unfavorable.” Users in this range are new to credit or have serious issues with their credit history. Users in this range may still get loans but at significantly higher rates.

- Below 500 – This range is “Deficient.” Users in this range are new to credit or have had significant defaults or other negative marks. Users in this range may find it hard to get loans.

-

No, IMCU uses their lending criteria when making final loan decisions and has no access to SavvyMoney Credit Score. However, through SavvyMoney Analytics we can see what offers users are viewing and engaging with.

-

No, SavvyMoney Credit Score is a free service to help users understand their credit health, make improvements in their scores, and see loan and credit card offers from IMCU. IMCU doesn’t have access to users’ credit files with SavvyMoney unless the users choose to share them. If they would like to share, they can easily do so by navigating to the Credit Report tab and clicking “Download Report” to share at their discretion.

-

SavvyMoney has implemented bank-level encryption and security policies to keep our user's data safe and secure. SavvyMoney also has a sophisticated system that scans for, and thwarts online bots, intrusions, and attacks.

SavvyMoney’s policies and processes are reviewed annually by a third-party auditor and have been verified by multiple digital banking platforms' Security and Compliance teams to meet their stringent security guidelines to keep both users' and financial partners' data safe and secure.

-

The SavvyMoney Credit Score is not intended to be comprehensive and may not provide all information about user accounts. We encourage users to take advantage of obtaining free credit reports from www.annualcreditreport.com to look for any incorrect information or discrepancies across all three bureaus. Each bureau has its process for correcting inaccurate information, but every user can “File a Dispute” by clicking on the “Dispute” link within their SavvyMoney Credit Report. For more information about disputes. The Consumer Financial Protection Bureau website offers step-by-step instructions on how to contact the bureaus and correct errors.

-

Based on their SavvyMoney credit score information, users may receive IMCU pre-qualified offers (invitation to apply) on products that may be of interest to them. In some cases, these offers may have lower interest rates than the products they already have or can save them money on their monthly payments.

The educational articles, written by Jean Chatzky and the SavvyMoney team, are designed to provide helpful tips on how users can better manage their credit, debt, and financial health.

- If a user has a low credit score, and doesn’t qualify for product offers, they will be shown educational articles or products they qualify for (if offered).

- No. Checking SavvyMoney Credit Score is always a “soft inquiry,” which does not affect credit scores. Typically, ‘Hard inquiries’ are used by lenders to make decisions about their creditworthiness when users apply for loans. Multiple hard inquiries can lower a credit score.

-

Yes. When a user successfully enrolls in the credit score solution, they are automatically enrolled in credit monitoring. Their file is scanned daily for key changes, and an alert is sent when a significant change is detected. These alerts are provided within digital banking and via email. The user can update their email preferences for SavvyMoney emails by navigating to “Resources” and the “Profile Settings” section.

SavvyMoney will provide the following monitoring alerts:

- An account has been included in bankruptcy.

- An account is reported as delinquent.

- A fraud alert has been placed on the credit file.

- A previously derogatory account is now current.

- A new account has been opened.

- An account in your name shows a different address.

- An account in your name listed a new employer.

- A new inquiry on the credit file.

- A new public record has been reported.

-

Users who access the SavvyMoney program through their digital banking do not need to update their information directly with SavvyMoney. When a member changes their email address or other personal information in their digital banking profile, SavvyMoney automatically updates that information on its side as well. SavvyMoney always encourages the user to inform their financial institution of any contact information updates.

If a financial institution offers SavvyMoney from outside of digital banking, users can update their profile from the “Profile Settings” section under “Resources” within the tool.

-

Yes, users can easily choose when SavvyMoney contacts them. Navigate to the “Resources” tab and then under “Profile Settings” users can choose which email notifications they receive. SavvyMoney sends out three types of emails: Credit Monitoring Alerts, General Messages, and Monthly Notices. Users will be automatically enrolled in all email communications and can easily unselect the specific email types they do not wish to receive.

-

Yes, SavvyMoney Credit Score and all other features are available to use on mobile and tablet devices and are integrated within our mobile banking application.

What is VantageScore®?

- VantageScore® was developed by a representative team of statisticians, analysts, and credit data experts from each of the top three credit reporting agencies - Equifax, Experian, and TransUnion, as an alternative to FICO scores. VantageScore® is used by hundreds of financial institutions, including credit unions, banks, credit card issuers, mortgage lenders, and SavvyMoney.

The VantageScore® 4.0, the score displayed in SavvyMoney, is the newest version of VantageScore®. It is calculated on a scale of 300-850, with 300 being the lowest and 850 the highest score.

What factors influence my credit score?

Five major categories make up a VantageScore® 4.0 credit score:

- 41% Payment History. Lenders want to see that you consistently pay your loans on time.

- 22% Credit Usage. Credit usage, or credit utilization, is the ratio between the total amount of credit used vs. your total credit limit on revolving accounts. Aim to keep your credit usage below 30%.

- 20% Credit Age. The age of your oldest account, the age of your newest account, the average age of your accounts, and whether you’ve used an account recently are all factors related to the length of your credit history. In general, the longer your credit history the better.

- 11% Inquiries. Applying for multiple credit accounts in a short window of time may convey to potential lenders that you cannot qualify for credit or are in desperate need of money. Try to limit new applications and credit inquiries for when you really need them.

- 6% Account Mix. Your credit mix considers the number of accounts you have and what types of credit you have. Your score will likely be higher if you have experience with different kinds of credit, installment loans like mortgages or auto loans, and revolving accounts like credit cards.

Do race, age, and other, non-credit-related factors affect my VantageScore® credit score?

-

No. The VantageScore® model does not consider race, color, religion, nationality, sex, marital status, age, salary, occupation, title, employer, employment history, where you live, or where you shop, in credit score decision-making.

Building Credit

Are charge cards treated the same as credit cards by credit scoring models?

- Charge cards and credit cards are similar in function but differ in credit scoring. Charge cards don’t have a set credit limit and the balance is due in full each month. Credit cards do have a set credit limit and the balance can be carried over or revolve from month to month.

- Without a credit limit, charge cards don’t factor into your credit utilization, but because charge cards are paid off monthly, they do factor into the payment history component of your VantageScore®.

Is medical debt a factor in my credit score?

- VantageScore® 4.0 does not include medical collections in its scoring models after determining that medical debts are not predictive of a consumer’s creditworthiness.

- Source: https://www.vantagescore.com/vantagescore-4-0-fact-sheet/

Does shopping for a loan hurt my VantageScore® credit score?

-

Consumers are encouraged to shop for the best loan rates and terms. VantageScore® model counts multiple inquiries made within a 14-day period as a single inquiry. The impact to your score from a single inquiry is minor and temporary.

If I don’t have a long credit history, can I still get a VantageScore® credit score?

-

Yes. One of the differentiating factors of VantageScore® 4.0 is the ability to generate scores for more consumers because it considers the entirety of a consumer's history not just the past 24 months. This helps those with thin credit files, those new to credit, and those considered “unscorable” by traditional credit scoring models.

Learn More About VantageScore® 4.0

What happened to VantageScore® 3.0?

- Your financial institution chose to enhance your Credit Score experience by updating from VantageScore® 3.0 scoring model to VantageScore® 4.0.

Why is the switch from VantageScore® 3.0 to VantageScore® 4.0 important?

- The previous version of your Credit Score experience, including your credit score, rate, and offer(s) displayed, was based on the VantageScore® 3.0 credit score model. Your financial institution uses the VantageScore® 4.0 scoring model to review loan applications and make lending decisions. For a consistent experience and greater accuracy, your financial institution now shows your credit score, rate, and offer(s) based on the VantageScore® 4.0 model.

- The Credit Score experience is provided for educational purposes only and intended to help you understand the factors that affect your credit score and find ways to save money on loans and offers.

What are the main differences between VantageScore® 3.0 and VantageScore® 4.0 and how does VantageScore® 4.0 benefit me?

- VantageScore® 3.0 is a snapshot of your credit at a moment in time.

- VantageScore® 4.0 looks at trends in your credit behavior and debt management over time. This gives lenders greater context into your overall situation, progress, and behavior to more accurately assess creditworthiness when you apply for a mortgage or loan.

- VantageScore® 4.0 uses machine-learning technology to better predict the behavior of consumers with thin credit histories or who were previously unable to receive a score with traditional scoring models.

Here is a breakdown of the differences in each credit factor for VantageScore® 3.0 and 4.0:

| Credit Factor | VantageScore® 3.0 | VantageScore® 4.0 |

|---|---|---|

| Payment History | 40% | 41% |

| Credit Usage | 23% | 22% |

| Inquiries | 5% | 11% |

| Account Mix | 11% | 6% |

-

The largest point change in VantageScore® 4.0 is Inquiries and Account Mix. (See Chart) VantageScore® felt that Inquiries (applying for and opening new accounts) were more indicative of consumer behavioral characteristics which is why it is weighted more heavily. Account Mix is considered less a part of trended behavior and is weighted accordingly in VantageScore® 4.0.

Will this update impact my current credit score?

-

You may see a slight change in your VantageScore® 4.0 credit score. Each VantageScore® update is an improvement on the previous version. This may increase the likelihood of slight score improvements from one iteration to the next. Individual results may vary.

Will this model update change any other aspects of my credit score experience?

-

Financial Checkup and Your Credit Score Action can still be accessed through digital banking.

Unfortunately, Score Simulator and Credit Score Goals are temporarily disabled. We are working directly with VantageScore® to develop updated versions of these financial tools.

Will I be able to check/refresh my VantageScore® the same way?

-

You can access and refresh your score and report when you log into digital banking.

Can I still see my VantageScore® 3.0 credit score?

-

The credit score displayed when you log into digital banking is your VantageScore® 4.0 score. Your financial institution has chosen to display your VantageScore® 4.0 within the Credit Score experience, your VantageScore® 3.0 is no longer available to view.

The SavvyMoney Credit Score is not intended to be comprehensive and may not provide all information about user accounts. We encourage users to take advantage of obtaining free credit reports from www.annualcreditreport.com to look for any incorrect information or discrepancies across all three bureaus. Each bureau has its process for correcting inaccurate information, but every user can “File a Dispute” by clicking on the “Dispute” link within their SavvyMoney Credit Report. For more information about disputes. The Consumer Financial Protection Bureau website offers step-by-step instructions on how to contact the bureaus and correct errors.